Page 4 - Demo

P. 4

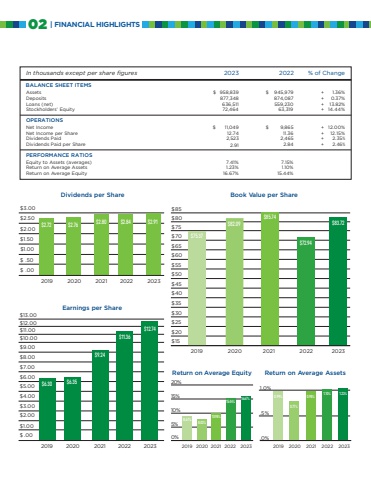

02 | FINANCIAL HIGHLIGHTSIn thousands except per share figures 2022 % of ChangeBALANCE SHEET ITEMSAssets + 1.36Þposits + 0.37%Loans (net) + 13.82%Stockholders’ Equity + 14.44%OPERATIONSNet IncomeNet Income per Share + 12.15%Dividends Paid + 2.35%Dividends Paid per Share + 2.46%PERFORMANCE RATIOSEquity to Assets (averages)Return on Average AssetsReturn on Average Equity2023$ 958,839877,348636,51172,464$ 11,04912.742,5232.917.41%1.23.67%$ 945,979874,087559,23063,319$ 9,86511.362,4652.847.15%1.10.44%$50$55$60$65$45$40$35$30$25$20$15$70$75$80$85 2019 2020 2021 2022 2023$75.37$82.09$85.74$72.94$83.72Book Value per Share$3.00$2.50$2.00$1.50$1.00$ .501$ .00$2.72 $2.76 $2.80 $2.84 $2.91Dividends per Share 2019 2020 2021 2022 2023$10.00$11.00$9.00$8.00$7.00$6.00$5.00$4.00$1.00$2.00$3.00$ .001$6.30 $6.35$9.24$11.36$12.74$12.00$13.00Earnings per Share 2019 2020 2021 2022 2023Return on Average Equity2019 2020 2021 2022 202315%5%0 %8.61% 8.02.98.44% 16.67%1.0%.5%.0%Return on Average Assets2019 2020 2021 2022 20230.99%0.77%0.98% 1.10% 1.23%+ 12.00%