Page 6 - Demo

P. 6

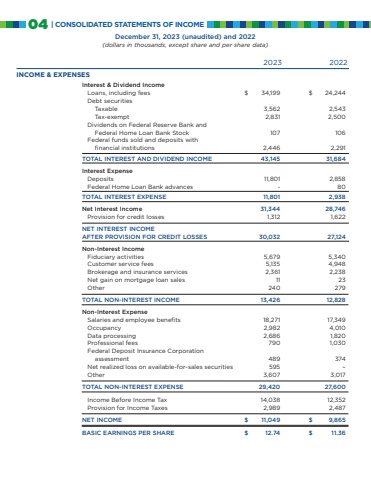

INCOME & EXPENSESInterest & Dividend IncomeLoans, including fees $ 34,199 $ 24,244 Debt securities Taxable 3,562 2,543 Tax-exempt 2,831 2,500 Dividends on Federal Reserve Bank and Federal Home Loan Bank Stock 107 106 Federal funds sold and deposits with financial institutions 2,446 2,291 TOTAL INTEREST AND DIVIDEND INCOME 43,145 31,684Interest ExpenseDeposits 11,801 2,858 Federal Home Loan Bank advances - 80 TOTAL INTEREST EXPENSE 11,801 2,938 Net Interest Income 31,344 28,746 Provision for credit losses 1,312 1,622 NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES 30,032 27,124 Non-Interest IncomeFiduciary activities 5,679 5,340 Customer service fees 5,135 4,948 Brokerage and insurance services 2,361 2,238 Net gain on mortgage loan sales 11 23 Other 240 279 TOTAL NON-INTEREST INCOME 13,426 12,828 Non-Interest ExpenseSalaries and employee benefits 18,271 17,349 Occupancy 2,982 4,010 Data processing 2,686 1,820 Professional fees 790 1,030 Federal Deposit Insurance Corporation assessment 489 374 Net realized loss on available-for-sales securities 595 – Other 3,607 3,017 TOTAL NON-INTEREST EXPENSE 29,420 27,600Income Before Income Tax 14,038 12,352 Provision for Income Taxes 2,989 2,487 NET INCOME $ 11,049 $ 9,865BASIC EARNINGS PER SHARE $ 12.74 $ 11.362023December 31, 2023 (unaudited) and 2022(dollars in thousands, except share and per share data)202204 | CONSOLIDATED STATEMENTS OF INCOME