Page 8 - Demo

P. 8

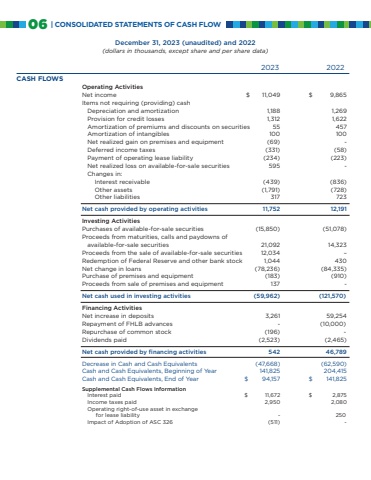

December 31, 2023 (unaudited) and 2022(dollars in thousands, except share and per share data)CASH FLOWSOperating ActivitiesNet income $ 11,049 $ 9,865Items not requiring (providing) cash Depreciation and amortization 1,188 1,269Provision for credit losses 1,312 1,622Amortization of premiums and discounts on securities 55 457Amortization of intangibles 100 100Net realized gain on premises and equipment (69) -Deferred income taxes (331) (58)Payment of operating lease liability (234) (223)Net realized loss on available-for-sale securities 595 -Changes in: Interest receivable (439) (836) Other assets (1,791) (728) Other liabilities 317 723Net cash provided by operating activities 11,752 12,191Investing ActivitiesPurchases of available-for-sale securities (15,850) (51,078)Proceeds from maturities, calls and paydowns of available-for-sale securities 21,092 14,323Proceeds from the sale of available-for-sale securities 12,034 –Redemption of Federal Reserve and other bank stock 1,044 430Net change in loans (78,236) (84,335)Purchase of premises and equipment (183) (910)Proceeds from sale of premises and equipment 137 -Net cash used in investing activities (59,962) (121,570)Financing ActivitiesNet increase in deposits 3,261 59,254Repayment of FHLB advances - (10,000)Repurchase of common stock (196) -Dividends paid (2,523) (2,465)Net cash provided by financing activities 542 46,789Decrease in Cash and Cash Equivalents (47,668) (62,590)Cash and Cash Equivalents, Beginning of Year 141,825 204,415Cash and Cash Equivalents, End of Year $ 94,157 $ 141,825Supplemental Cash Flows InformationInterest paid $ 11,672 $ 2,875Income taxes paid 2,950 2,080Operating right-of-use asset in exchange for lease liability - 250Impact of Adoption of ASC 326 (511) -2023 202206 | CONSOLIDATED STATEMENTS OF CASH FLOW